7 good reasons to buy a villa in Bali

12/12/2025

Bali real estate Investor tips UncategorizedIf you’re an investor, or if you have substantial assets, you know how important it is to invest your money in different categories of stocks, bonds, bank investments or real estate… so as not to find yourself dependent on a single type of asset should it lose value. This is diversification by asset type, which is always recommended in France.

But diversification isn’t just a question of product type: for optimal investments, it’s advisable to be open to international markets. Diversifying currencies and countries of investment also helps to limit risk while taking advantage of opportunities.

Overview of the various asset diversification methods.

When you invest in the stock market, you have the possibility of obtaining very good returns, but also of losing all or part of your capital. This is particularly true in times of crisis, when markets are highly volatile.

Investing in real estate as a complement to stock market investments can provide security. Buying in stone, with a tangible asset, provides greater security for the capital invested. In Thailand, it’s possible to buy completed, freehold properties in the case of a Condominium: you own the walls of your property. Prices may fluctuate, but the longevity of the stone does not depend on the stock markets.

Currency diversification means holding bank accounts and/or investments in currencies other than the euro, so you can benefit from fluctuations in these currencies.

For example, the dollar is historically very strong. On August 1, 2022, it is almost equivalent to the Euro (1€ = 1.02 USD), whereas 1 year ago, on August1, 2021, the ratio was 1 Euro to 1.18 USD.

A property purchased in August 2021 at USD 230,000 had a Euro value of around €193,000. Today, taking only the exchange rate into account, this property has a value of around €224,250.

The dollar has the advantage of being a global currency: it is used in Southeast Asia, for example, in Cambodia and the Philippines. Nor is it dependent on a single economy, and is in demand all over the world, making it a good currency for diversification, particularly in times of crisis.

If you’re thinking ofinvesting in Thailand, the Thai Baht is still considered the safest currency in Southeast Asia.

Thailand has learned its lessons from the 1997 crisis, and its historically stable currency makes it one of the best-performing emerging countries in Southeast Asia. Despite its weak performance in 2021 due to the absence of tourists, the Thai Baht has re-established itself as the benchmark currency in Southeast Asia for the start of 2022.

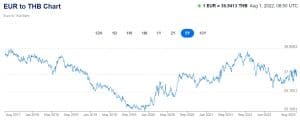

5-year EUR – THB exchange rate chart to August1, 2022

Source: XE Currency: https: //www.xe.com/currencycharts/?from=EUR&to=THB&view=5Y

Diversifying your assets geographically means investing in a country other than your own. Real estate investment or purchase is then linked to the country’s environment and legislation.

This can be a good way to take advantage of more attractive tax or other legislation than in France.

For example, if you invest in real estate in Thailand and are a Thai tax resident, your property will be taxed in Thailand, not in France. There is no inheritance tax below THB 100 million.

If you are a French tax resident, the double taxation treaty between France and Thailand allows your assets taxable in Thailand to be exempt from French tax. For example, rental income generated on Thai soil will be governed by Thai legislation – which is lighter on income tax – and will not be taxed in France. However, you still need to declare your foreign assets to the French authorities.

It’s also important to check with your tax advisor which taxes and laws apply to you personally, depending on your situation.