7 good reasons to buy a villa in Bali

12/12/2025

Bali real estate Investor tips UncategorizedTranslation and adaptation of the Bangkok Post article of March 2023: https: //www.bangkokpost.com/thailand/pr/2530436/scb-eic-upgrades-thailands-2023-gdp-growth-to-3-9-/

According to EIC forecasts, foreign tourist arrivals will probably reach 30 million by 2023, returning to a pace closer to that of the pre-pandemic period by the end of 2024.

With China having lifted its “Zero COVID” restrictions, the number of Chinese visitors is set to rise again to around 4.8 million this year, in tandem with improved tourist arrivals from other countries. This should support the labor market and the recovery in consumption. In regions with high tourist numbers, particularly on islands such as Phuket and Koh Samui, this upturn in activity has benefited hotels, and Thailand’s real estate market in general has benefited from the return of visitors and investors since the start of the year.

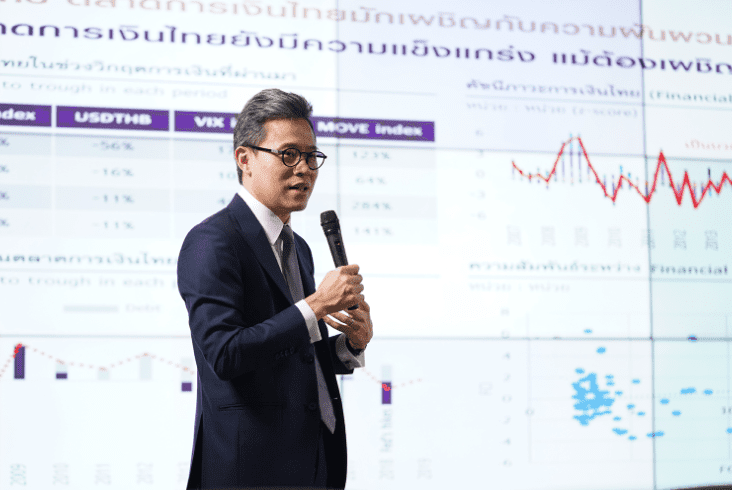

Regarding the global outlook, Somprawin Manprasert, Director of Strategy and Chief Economist at Siam Commercial Bank PCL, said:

“SCB EIC expects the global economy to perform better than expected. We have therefore raised our global economic forecasts from 1.8% to 2.3%. […]“

As far as the Thai economy is concerned, tourism and consumption by both Thai households and international visitors will be important drivers of development:

“In our view, the tourism and consumer sectors will be important drivers of the Thai economy in 2023. The return of international tourists should support businesses in the tourism ecosystem, especially those that rely heavily on Chinese tourists. In addition, the Thai labor market has regained its pre-pandemic dynamism thanks to a dynamic economic recovery and the return of workers to the tourism and service sectors, which translates into higher wages in the tourism industry.”

Somprawin Manprasert then lists the risks that Thailand may face:

“The Thai economy continues to face major risks:

In addition, growing concerns about global stability represent a new risk that needs to be closely monitored. As long as central banks can provide sufficient and timely liquidity, confidence in the stability of the banking system should be maintained”.

In terms of opportunities for investors, it is currently attractive to invest on Phuket Island in completed freehold real estate developments: these are currently benefiting from the return of international visitors to the island, and do not represent a concrete investment in a property that has already been built.

Contact Osiris Investissements

for more information on real estate investment in Thailand.