Tax treaty France – Thailand

– A double taxation treaty was signed on August 29, 1975 between the governments of Thailand and France.

– The purpose of this tax treaty is to ensure that income is not taxed twice.

– Income from property located in Thailand will be taxed in Thailand, where the tax rate is advantageous.

Income tax on real estate investment

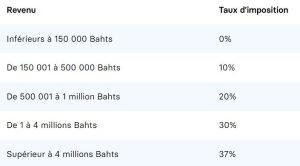

Income from real estate in Thailand is taxable in Thailand under the double taxation treaty. As in France, tax rates are calculated by bracket.

– If your income is less than 150,000 THB / year, you pay no tax.

– Between THB 150,000 and THB 500,000 / year, you will be taxed at 10%. You’ll find yourself in this bracket in the example of an investment of THB 4,000,000 at 8% return / year.

The tax scale in Thailand

(Updated August 2022, source: https: //sirelo.fr/)

Income tax on real estate investment

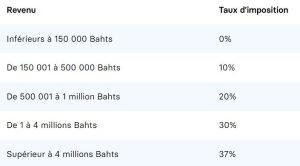

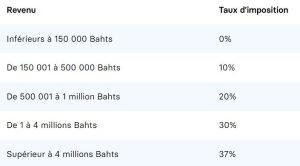

Income from real estate in Thailand is taxable in Thailand under the double taxation treaty. As in France, tax rates are calculated by bracket.

If your income is less than 150,000 THB / year, you pay no tax.

Between THB 150,000 and THB 500,000 / year, you will be taxed at 10%. You’ll find yourself in this bracket in the example of an investment of THB 4,000,000 at 8% return / year.

The tax scale in Thailand

(Updated August 2022, source: https: //sirelo.fr/)

Withholding tax

When you own rental property in Thailand, income tax is levied in the form of a Withholding Tax .

Thai taxes deduct a fixed percentage of your income each year. This percentage is 5% if you have a bank account in Thailand, or 15% if you have a bank account abroad.

At the end of the year, you can request a refund of this Withholding tax if your actual tax liability is less than the amount deducted.

For example, if your annual income is less than 150,000 Bahts, you can request a refund of the entire tax deducted.

No CSG on your property income

By investing in real estate in Thailand, you’ll immediately save 17.2% CSG RDS on property income!

Thanks to the non-taxation agreement between France and Thailand, income and capital gains from your real estate are taxable in Thailand, not in France.

No IFI, symbolic property tax and low acquisition costs.

– Property wealth tax does not exist in Thailand. Neither is the equivalent of the taxe d’habitation.

– The property tax rate is less than 1%.

– When buying a house or apartment, the buyer’s acquisition tax is 1.2 to 3.15% of the property price , shared between the seller and the buyer.

A will to pass on your estate

You can pass on your Thai assets to your children, relatives or whomever you wish by drawing up a will.

– To optimize your estate, we recommend that you consult a lawyer specialized in this field, who will draw up your will.

– Although not compulsory, it is particularly important for you to be able to choose who your heirs will be.

– There is no inheritance tax for tax residents under 100 million baths (3 million euros at the current exchange rate). Inheritance tax is applicable above this amount, but remains very low (5 to 10%).

Tailor-made support in France and Thailand

Benefit from a secure purchasing process, with support that takes into account all the specifics of your investment.

We put our network of specialists at your disposal: lawyers, tax specialists… Our main mission is to be at your side at every stage of your acquisition and to advise you.

Our knowledge of the market, our presence in France and on the ground, and our ability to listen to our customers make us the ideal allies when it comes to real estate investment in Thailand.

We would be happy to call you back to discuss investment opportunities and/or to arrange a meeting.