7 good reasons to buy a villa in Bali

12/12/2025

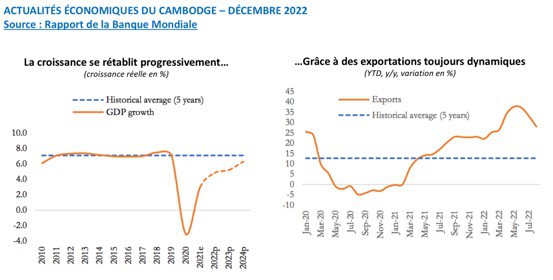

Bali real estate Investor tips UncategorizedIn this article an overview of Cambodia’s economy, according to the World Bank Group’s December 2022 report.

Cambodia’s economy is largely focused on exports of manufactured goods, particularly textiles. These exports recorded strong growth in 2022, jumping 28.6% year-on-year in the first eight months of the year, exceeding its pre-pandemic growth rate.

Like most countries in the world, Cambodia is affected by geopolitical conditions and global inflation. Rising energy prices in particular, and a prolonged slowdown in demand from its customers (notably the USA, Europe and China) represent the main threats to Cambodia in 2023.

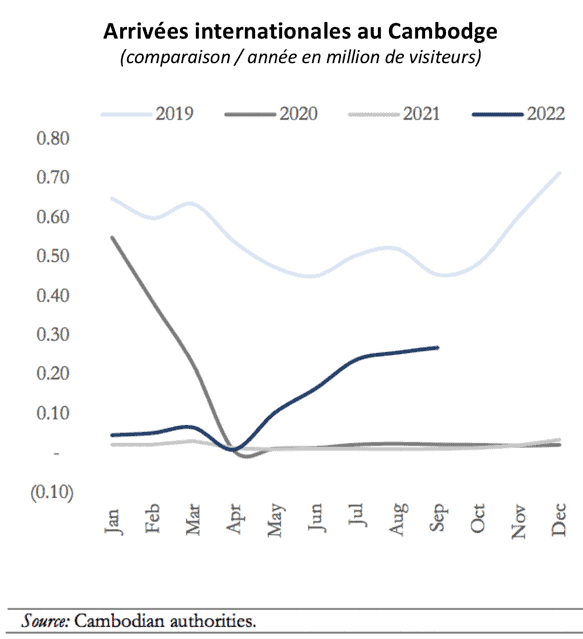

Cambodia’s second-largest business sector is services and tourism, which has begun to recover with Cambodia’s “living with COVID” strategy inaugurated in December 2021, which introduced several social, health, regulatory and fiscal measures.

Total international arrivals reached 1.2 million in the first 9 months of 2022 (spread mainly over the months of May to September), with travel facilitated by the reinstatement of the “Visa on Arrival”, as well as the abolition of COVID tests and compulsory vaccination certificates.

The most popular tourist towns, such as Sihanoukville and Siem Reap, are gradually receiving more tourists, and are supported by public and private infrastructure development projects.

Cambodia’s second-largest city after the capital Phnom Penh, Siem Reap is home to the temples of Angkor Wat, a UNESCO World Heritage Site.

In October 2021, the Cambodian government set up a long-term project to develop Siem Reap’s tourism sites, infrastructure, sustainability and connectivity. In March 2022, Siem Reap inaugurated 108 kilometers of road network thanks to a public investment plan. In 2022 – 2023, Cambodia plans to introduce financial incentives to support eco-sustainable projects and innovative investments in the tourism sector.

In addition to tourism, the upturn in travel is seeing the return of business travelers, who are generating demand for short- and medium-term stays in hotels or apartments with rental management.

Local demand continues to support occupancy rates for entry-level and mid-range apartments inQ3 2022. Demand is also stabilizing in the downtown professional office sales and rentals sector, with average occupancy rates of 70% inQ2 2022 as face-to-face working picks up again.

In terms of real estate development, the frequency of new project construction is likely to remain more moderate than in the past, particularly in Sihanoukville, Cambodia’s fastest-growing city in terms of pre-pandemic real estate construction.

Today, government plans in towns such as Sihanoukville and Siem Reap call for a transition to more sustainable and qualitative growth, with facilities that would be suitable for attracting European and American investors and occupiers.

These are indicators for investors that there will be opportunities to be seized in the coming years, according to Knight Frank’s study for thefirst half of 2022.

For 2023, Cambodia will have to navigate an uncertain global economy. To mitigate the impact of inflation on energy and food prices, the authorities plan to introduce additional social assistance measures, on top of the aid programs already introduced during COVID-19.

To best develop these sectors and stand alongside its historically attractive neighbors such as Thailand and Indonesia, Cambodia still needs to invest in its road and port infrastructures, in sustainable development and in its attractiveness to professionals and business travelers.

Development projects such as the one to be launched in Siem Reap in 2021 should help to make Cambodia a more connected and competitive country for foreign investors and travelers in the coming years.

Osiris Investissement is diversifying in Cambodia with a real estate investment offer that takes advantage of the development prospects of Siem Reap and Cambodia.

Sources :