7 good reasons to buy a villa in Bali

12/12/2025

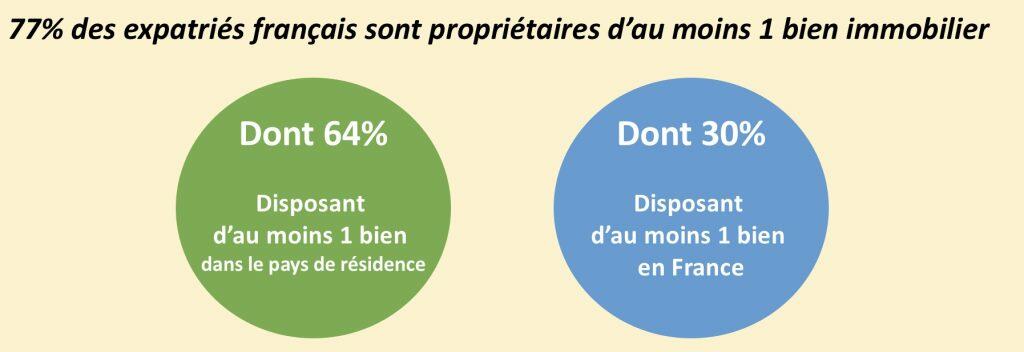

Bali real estate Investor tips UncategorizedWith almost 5,000 responses, the survey reveals that 77% of French expatriates – in all countries – own at least one property. This proportion rises to 64% for French residents. This higher figure abroad can be explained by a greater number of “CSP+” profiles, who are also older and have been living abroad for a long time.

Among the 77% of homeowners, over 60% own a property in their current country of residence, and 30% own a property in France.

Of all expatriates responding to the survey, 52% say they intend to buy a property: 29% want to buy in France and 27% want to buy in their country of residence, in 2023 or in the longer term.

So what are their reasons for buying?

The purchase of a principal residence is essentially linked to retirement or work, while a second home is a pied-à-terre for an expatriate for part of the year, or for family and children.

As for rental investment – whether in France or abroad – it is also popular for building up savings or generating additional income. It’s worth noting that preparing for retirement is a dominant concern in property purchases for French expatriates who have worked abroad for a long time, and who therefore benefit little or not at all from the French pension system.

What problems do French buyers from abroad encounter? When it comes to buying in their country of residence, 56% consider property prices to be too high, particularly for expatriates living in the developed countries of Europe, the United States and Japan. On the other hand, it is possible to find opportunities in Southeast Asian countries such as Thailand and Cambodia, which have particularly attractive markets for foreigners.

Another barrier to buying abroad is the language barrier: it’s more difficult to buy when you’re unfamiliar with the language, or when the person you’re talking to belongs to a different culture.

When buying in France, another major hurdle is taxation. Indeed, French nationals living abroad do not enjoy any tax advantages from investing in real estate in France, as their rental properties in France are taxed in the same way as French residents.

Are you an expatriate or French resident looking to discover real estate abroad? Osiris Investissement offers real estate in Southeast Asia and the United States through its French experts and partners, present in each destination. Please contact us to find out more.